San Vicente, Palawan, with its pristine beaches and stunning natural beauty, has quickly emerged as a prime destination for both tourists and investors alike. Its crown jewel, Long Beach, spans an impressive 14.7 kilometers, making it the longest white sand beach in the Philippines. This beautiful coastline has attracted early investors since the early 2000s, leading to a limited availability of beachfront properties for sale today.

If you're looking to invest in this paradise, now is the time. With an increasing scarcity of beachfront and commercial lots, properties in San Vicente are quickly becoming more valuable. In this guide, we’ll dive into the current state of the real estate market in San Vicente, explore the challenges of limited inventory, and highlight opportunities in rice field properties that offer great potential for future development.

The Growing Demand and Limited Beachfront Properties in San Vicente

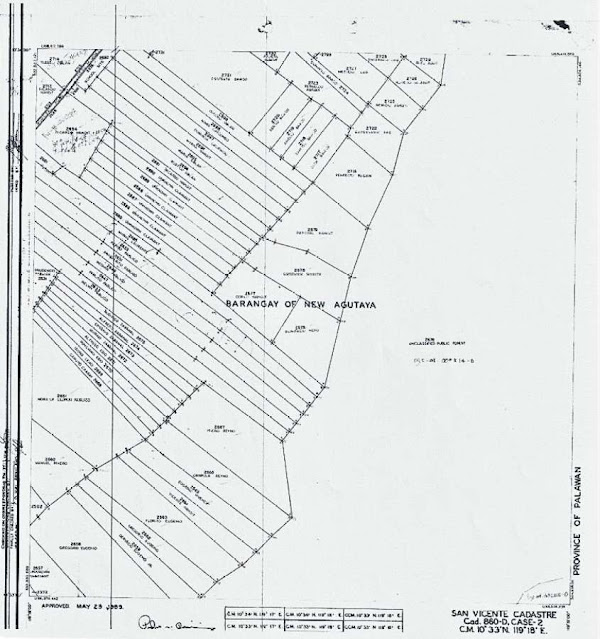

Long Beach, the main attraction in San Vicente, has been a magnet for investors since 2001. Over the years, many large-scale developers have secured prime locations along the beachfront, leaving fewer opportunities for new investors. This early wave of development has resulted in a significant reduction in the availability of beachfront properties—particularly in the four barangays that make up Long Beach: Poblacion, New Agutaya, San Isidro, and Alimanguan.

1. Resale Properties Dominate the Market

Resale Beachfront Properties: The majority of beachfront properties available today are resale properties, originally owned by locals and now being sold by investors who purchased early. These resale properties typically come with a higher price tag due to the increasing demand and limited supply. If you’re looking to invest in beachfront real estate in Long Beach, expect to pay a premium, but also anticipate substantial returns as property values continue to rise.

Larger Investments for High-End Development: Many of the larger properties (1 hectare or more) along the beachfront have already been purchased by developers planning to build high-end resorts and hotels. This has left limited options for smaller investors, particularly those looking to buy smaller lots at more affordable prices.

2. Opportunities Beyond Long Beach

Beachfront Properties Outside Long Beach: While Long Beach remains the most sought-after location, there are still beachfront properties available outside the Tourism Enterprise Zone (TEZ) in areas like Macatumbalen, Kemdeng, Port Barton, Caruray, Binga, New Canipo, and remote islands like Boayan. These areas, though less developed, offer comparatively cheaper properties and have significant potential, especially as infrastructure and access roads are developed.

Future Development: Although beachfront properties outside Long Beach may currently lack the same level of development, they offer a unique opportunity for investors who are willing to wait for infrastructure improvements. With the ongoing development projects and growing tourism in San Vicente, these areas are poised for growth, making them excellent choices for land banking and long-term investments.

3. Why Beachfront Property Prices Will Continue to Rise

- The limited availability of beachfront lots in the Long Beach area has created a seller's market, giving lot owners the flexibility to set higher prices. As demand continues to grow and new developments come online, these properties will only become more expensive. For investors, this means that the sooner you invest, the better your chances of securing a prime location before prices climb even further.

Limited Commercial Lots for Sale in San Vicente

In addition to the scarcity of beachfront properties, there is also a limited number of commercial lots available along the main road in San Vicente, particularly those within walking distance to Long Beach. Investors began acquiring these strategic commercial properties as early as 2010, further reducing the number of available lots today.

1. Agricultural Classification

- Agricultural Zoning: It's important to note that San Vicente is still classified as an agricultural municipality, which means that many of the properties available for purchase are technically agricultural land. However, the term "commercial" is used in this guide to describe properties with commercial value due to their location along the main road and proximity to tourism zones.

2. Resale and Higher Prices

- Resale Commercial Lots: Similar to beachfront properties, many of the commercial properties available today are resale properties. These lots tend to come at a higher price than properties purchased directly from original owners due to increased demand and their prime location along the main road.

3. Opportunities in Lesser-Developed Areas

- Commercial Properties Outside Long Beach: For budget-conscious investors, there are still commercial and mixed-use properties available outside the Long Beach area, particularly in Macatumbalen, Kemdeng, Port Barton, Caruray, Binga, and New Canipo. These properties are generally more affordable than those within Long Beach, but they may require patience as infrastructure in these areas is still developing.

4. Act Quickly on Small Commercial Lots

- Grab Small Properties While You Can: Properties with less than 1,000 square meters of space are extremely rare, especially along the main road in San Vicente. If you find one, don't hesitate. These small lots can be resold at a much higher price due to their scarcity, offering a quick return on investment.

Rice Field Properties: A New Frontier for Investors

With the growing scarcity and rising prices of beachfront properties in Long Beach, many investors have turned their attention to rice field properties just behind the beach. These properties offer a more affordable alternative while still being within 1 kilometer of the beach and covered by the Tourism Enterprise Zone (TEZ).

1. Infrastructure Development

- Proposed 40-Meter Road Project: A 40-meter road development is proposed to be constructed in the rice field areas behind Long Beach, with access roads connecting this road to the beach. This infrastructure project has the potential to significantly increase the value of rice field properties, making them an attractive option for land banking.

2. Affordable Investment with Future Potential

- Lower Entry Prices: Compared to beachfront lots, rice field properties are currently much more affordable, making them a good option for investors with smaller budgets. As infrastructure develops and tourism continues to grow, the value of these properties is expected to rise.

3. Versatility for Development

- Potential for Mixed-Use Development: Rice field properties offer plenty of space for future development, from residential housing to commercial complexes and hotels. With proper planning, these properties could be developed into vibrant communities that benefit from their proximity to Long Beach and its growing tourism industry.

The Time to Invest is Now

The availability of beachfront and commercial properties in San Vicente is becoming increasingly limited, particularly in the highly sought-after Long Beach area. As demand continues to grow and infrastructure develops, property values are expected to rise significantly, making now the perfect time to invest.

Whether you're looking for a prime beachfront property, a commercial lot along the main road, or a rice field property with future potential, San Vicente offers a range of opportunities for both large-scale and budget-conscious investors. The key is to act quickly, as the limited supply and increasing demand will only drive prices higher in the years to come.

San Vicente Palawan Lot For Sale

Lot for Sale in San Vicente Palawan